Giants, Posey not rushing new deal

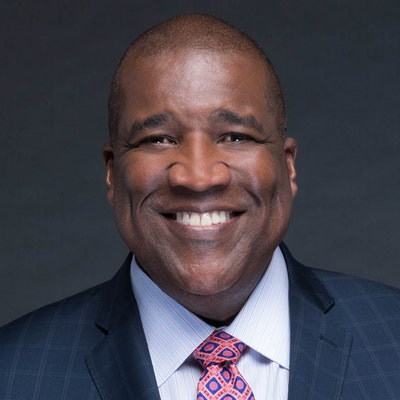

Good luck to the San Francisco Giants trying to figure out what catcher Buster Posey is worth long term.

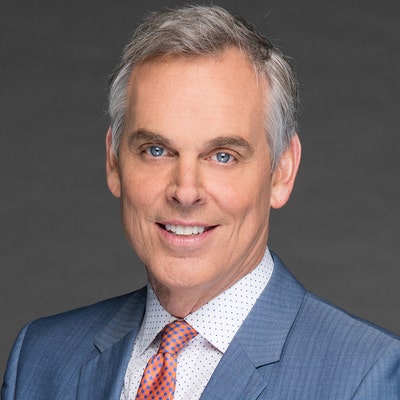

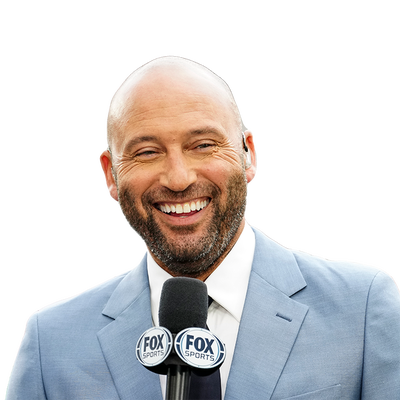

It’s not a stretch to imagine Posey replacing Derek Jeter as the game’s standard-bearer. Heck, the 25-year-old Posey already is more accomplished than Jeter at a comparable stage of his career, despite appearing in only 308 regular-season games.

Both players won Rookie of the Year awards and two World Series championships in their first three seasons. But Posey last season captured two honors that Jeter never has won, a batting title and MVP award.

Ka-ching!

Posey and the Giants recently agreed on an $8 million salary for 2013, a record settlement for a player in his first year of arbitration (the Philadelphia Phillies’ Ryan Howard earned $10 million in his first year, but “won” his salary in a hearing).

The two sides have mutual interest in reaching a long-term agreement, but no real urgency to complete such a deal, major league sources say.

Which probably is a good thing, seeing as how this baby could take time.

Posey is unique because of his special accomplishments, and because no one can predict how long he will remain at catcher, the position where his value is highest.

He started 111 games at catcher and 29 at first base last season, and should be athletic enough to remain behind the plate for many years. But the moment he becomes a full-time corner player — assuming that is where he will land — his offensive production will be less extraordinary.

Catchers’ salaries generally are lower due to the risk of injury, but Posey figures to make at least $40 million combined in his final three years of arbitration (he qualified for the extra year as a “Super Two” player).

He could seek a monster 10-year agreement, but might prefer a seven-year deal that would make him eligible for free agency at 32 — an age at which Victor Martinez and Jason Varitek landed their last big contracts.

So, let’s do the math:

Three arbitration years worth $40 million plus four free-agent years worth $80 million would amount to seven years, $120 million. And yes, given where Posey is starting in arbitration, his free-agent years almost certainly would be worth $20 million per season, if not more.

That $120 million is just an estimate — and it might be conservative, considering all of the game’s new revenues. Then again, the Giants might want more of a discount for signing Posey this early in his process, especially when he has played only one full season. They also might contend that he already has suffered one major, albeit freakish, injury — the broken fibula and torn ankle ligaments that ended his 2011 season in late May.

Again, it’s not an easy calculation.

Matt Swartz, who does an outstanding job projecting arbitration salaries for MLBTradeRumors.com, pegged Posey’s number for 2013 at $5.9 million. Seemed reasonable, considering that no player with as few plate appearances as Posey had ever earned more than $3.75 million in arbitration, according to MLBTR.

Well, Posey beat Swartz’s projection by $2.1 million — and that was just on a one-year deal. Who knows how high the long-term number might go?

Posey’s agent, Jeff Berry, could even counter the argument that his client would be less valuable at a position such as first base, contending that Posey likely would stay healthier and perhaps hit for even greater power.

For now, Posey wants to catch, he’s good at it and he seems to invite minimal wear-and-tear with his playing style.

He’s worth a ton of money. The question is how much.

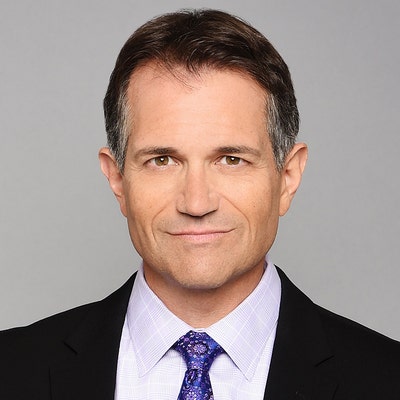

UNCERTAIN FUTURE FOR DODGERS' MATTINGLY

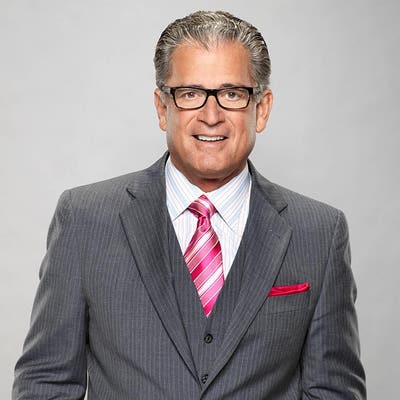

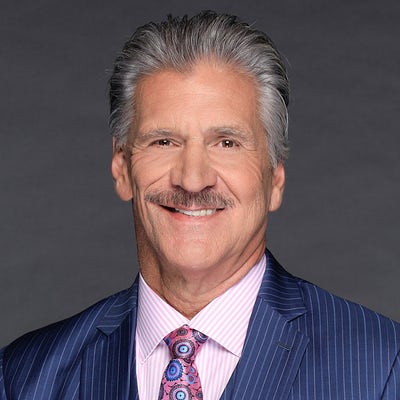

To understand why Los Angeles Dodgers president Stan Kasten never discloses the lengths of contracts for non-playing personnel, consider the case of Don Mattingly, the manager inherited by the team’s new owners.

Mattingly recently told Bill Plaschke of the Los Angeles Times that the team declined his request at the end of last season to exercise his option for 2014. Plaschke then posed the obvious question, with Mattingly entering the final year of his contract: Why are the Dodgers, after committing to a payroll of more than $200 million, going with a lame-duck manager in '13?

Some with the Dodgers dispute that assessment of Mattingly’s status, contending that the team should be good enough for him to avoid questions about his job security — and that any perceived distraction might only be a figment of the media’s imagination.

Perhaps, but I’m guessing the Dodgers will address the matter sooner rather than later, lest they undercut Mattingly’s authority in a clubhouse with no shortage of sizable egos. General manager Ned Colletti, who agreed to an extension last September, hinted at such a resolution to Plaschke, saying, “It will all get worked out.”

As Mattingly said, “… you would have liked for them to pick up the extension, so the players could be shown confidence. You never want it to be like, after a couple of bad games, people are saying, ‘Oh, are they gonna change managers now?’ ”

Of course, managers and coaches under long-term deals also can get fired — ask Ozzie Guillen, who lasted only one season of a four-year, $15 million deal with the Miami Marlins, or Mike Brown, whom the Los Angeles Lakers fired after a 1-5 start despite owing him a reported $11 million on his four-year, $18 million contract.

Still, the Dodgers would be wise to eliminate the issue entirely. Club officials privately rave about Mattingly. If they truly believe in him, they will not only exercise his option, but also award him an extension.

Just don’t expect them to announce the length of Mattingly’s new deal. That way, the team can avoid the question in the future, which is just how Kasten likes it.

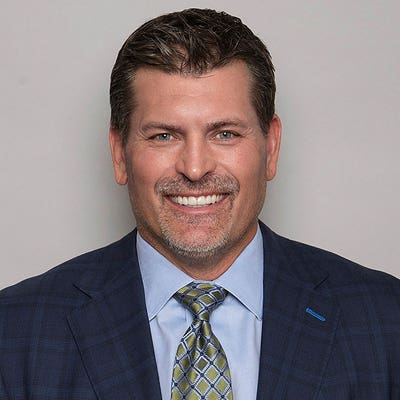

A FLAW IN THE YANKEES' PLAN?

The Yankees’ benefits for reducing their payroll below the $189 million luxury-tax threshold in 2014 might not be as lucrative as they originally envisioned.

The team would realize one financial incentive by meeting its payroll target — a rollback in its luxury-tax rate from a potential 50 percent to 17.5 percent if it again exceeded the threshold.

But the second anticipated benefit — a rebate in the new market-disqualification revenue-sharing program — might fall well below the Yankees’ expectations.

Under the labor agreement, the 15 clubs in the largest markets will forfeit an increasing percentage of their revenue-sharing proceeds starting in 2013, and become ineligible for any such money by '16.

The revenue-sharing funds that would have gone to those clubs then would be redistributed to payors such as the Yankees. The idea is to motivate certain big-market clubs — the Toronto Blue Jays, for example — to increase their revenues, knowing that they no longer would qualify for revenue-sharing money.

From that perspective, the plan appears to be working — the Blue Jays, Washington Nationals and Atlanta Braves are among the big-market clubs that anticipate higher revenues next season, according to major league sources.

Such developments would reduce the size of the market-disqualification pot — and in turn reduce the percentage of that pot the Yankees would receive.

The Yankees anticipated $10 million from the market-disqualification program if they got below the luxury-tax threshold one time and $40 million if they stayed under it from 2014 to '16, according to Joel Sherman of the New York Post.

If those figures turn out to be less than the Yankees projected, it would raise the question of why the team acted so diligently to get under $189 million by 2014.

Yankees officials, however, maintain that the team’s offseason strategy has not been influenced by future luxury-tax considerations. They say the front office simply is not enamored with the players on the market.