NFL players often prone to financial fumbles

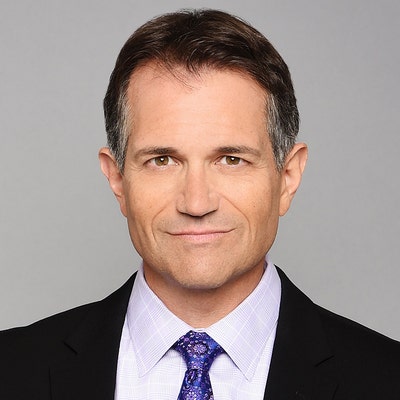

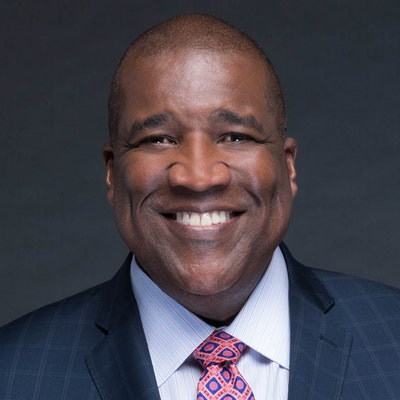

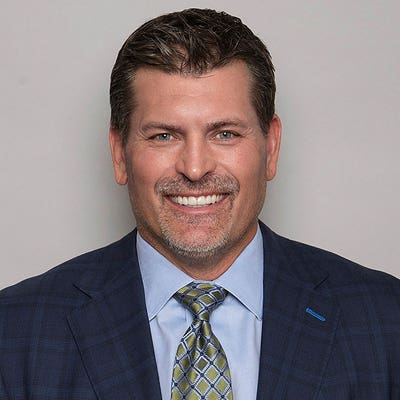

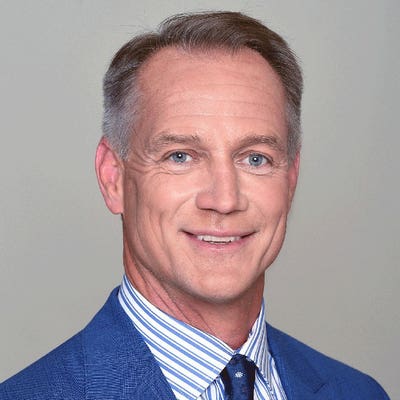

Danan Hughes endured a lot of crushing hits during six years in the NFL. The hardest blow of all, though, came at the end - when he went from mega-paycheck to no paycheck. Hughes grossed over $1 million as a wide receiver and special teams player for the Kansas City Chiefs, including close to $400,000 in each of his final two seasons. But when he retired in 1999, he took a three-month internship at a local bank that paid nothing. Talk about not being game-ready - he had just $70,000 savings from his entire career to fall back on. "Athletes tend to think they are invincible, and that's the way they handle their finances," says Hughes, 38. "But players often crash and burn with their money." Despite salaries averaging $1.1 million a year, financial success stories are rare after players step off the field for good. Whispers circulating around the league for years hold that many players end up in financial difficulties or bankruptcy soon after retirement, although player groups know of no formal data to back that up. Hughes bounced back quickly from his rocky transition to the real world. He has been a mortgage loan officer working with professional athletes for the past nine years and lives comfortably outside Kansas City with his wife and five children. But he and others are troubled by the fact that so many NFL players can't seem to break free of the pattern of rags to riches to rags again, especially with a potential lockout looming ahead that could force players to be self-reliant. Years of soaring salaries could come to a halt when the players' collective bargaining agreement ends after next season. If a lengthy work stoppage wipes out the 2011 season, as union representatives have warned it could, players will have to get by on no income in the middle of careers that last an average of just 3 1/2 years. Their plight may not elicit much sympathy at a time when unemployment tops 10 percent and running backs and linebackers can make more in a year than teachers or firefighters make in a lifetime. Their money woes, though, often are as much about joining the league with no background in managing money and being generous with friends and family as they are about greed and excessive spending. "Coming into big money so young is like hitting the lottery," says New York Jets guard Brandon Moore, an eight-year veteran. "A lot of guys just aren't ready for it." The players association is stepping up efforts to help prepare them now that a lockout may be nearing. The union has launched a "50/50" financial preparedness campaign, encouraging players to save at least 50 percent of their 2009 and 2010 salaries so they have a nest egg to rely on if the checks and benefits disappear. It also teamed earlier this year with a financial education company to provide an online platform that gives players access to guidance as well as qualified, screened advisers. Gary Smola, a certified financial planner with Manhattan Beach, Calif.-based Financial Finesse Inc., says the online tool teaches NFL players how to protect their income, buy a home, avoid fraud and draw up their after-football financial plans. Such advice may be too late for those who have already gone overboard with their spending. Jets' kicker Jay Feely says the first thing new players tend to do when they get into the league is spend at least $50,000 to $60,000 on a new car, even without a guaranteed playing contract in hand. He recalls seeing a late-round pick go out and buy a Hummer and then get cut before the end of training camp. Many also admit to him that they are not contributing to their 401(k) plan, to which the NFL kicks in a generous $2 match for every dollar they sock away. "You can't hold a guy's hand and make him learn things," says the 33-year-old Feely, a licensed stockbroker. "But hopefully we can help them get a better baseline of knowledge through these programs." His teammate Tony Richardson, a fullback who's in his 16th NFL season, still hears stories all the time about players investing with dubious financial advisers and getting taken for millions of dollars. Often it's through bad investments in restaurants, nightclubs and strip clubs - the three types of deals he was told in business school that you should always avoid. Richardson has learned to fend off acquaintances trying to take his money the way he might stiff-arm a would-be tackler. Twice in the past year, different college pals have called and urged him to get in on the ground level of a business that is "moving fast" but which they couldn't tell him much about. They promised returns of about 30 percent; he didn't return their calls. "I think financial responsibility comes with age and maturity," the 37-year-old Richardson says. "Some young guys just don't care financially. It really scares me to see them having all these kids with different women and not building a secure base. There's all kinds of things that can come about." Hughes, who works for U.S. Bank Home Mortgage in Kansas City, has an arsenal of his own money mistakes to point to when he works with players as clients. He bought a new Jeep Cherokee and a house before reporting to training camp as a seventh-round draft pick. He ordered the vehicle by phone with no clue about the lease terms. Like most of his teammates, he didn't pay much attention - or didn't understand - when speakers came in to talk to them about how to handle their finances. Now he's on the other end of those talks, hoping his words will serve as a wakeup call but realizing most will not heed them. "These guys will be going from high income to no income and child support and alimony in many cases," he says. "They have to learn that when they get off the football field they'll be starting over from scratch, maybe just a little bit of money in their pockets."