NFL voluntarily gives up tax-exempt status

By Andrea Hangst

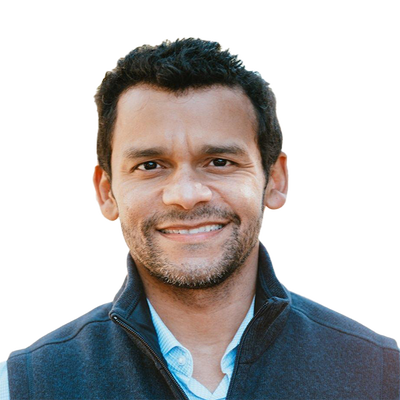

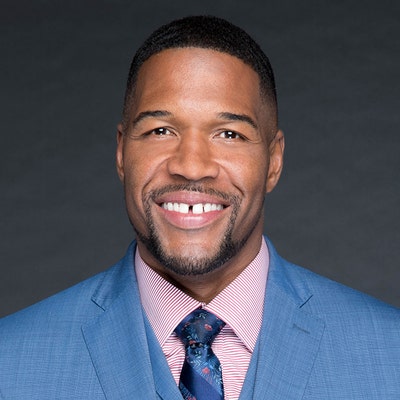

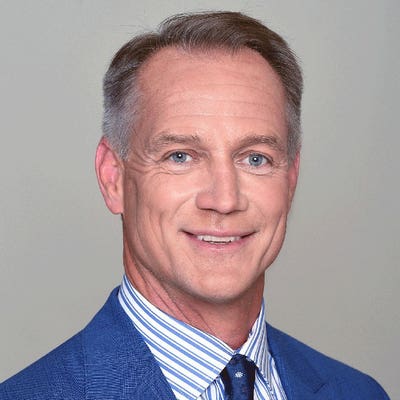

Since 1942, the National Football League has been considered a tax-exempt non-profit organization. While each of the league’s now-32 teams are taxable entities, the NFL’s league office has long been exempt. Now, the league has decide it is time for a change, with commissioner Roger Goodell informing teams on Tuesday that the league office will also be a taxable entity.

Goodell released a memo to all 32 teams on Tuesday. It reads (via USA Today's Brent Schrotenboer):

“As you know, the effects of the tax exempt status of the league office have been mischaracterized repeatedly in recent years. The fact is that the business of the NFL has never been tax exempt. Every dollar of income generated through television rights fees, licensing agreements, sponsorships, ticket sales, and other means is earned by the 32 clubs and is taxable there. This will remain the case even when the league office and Management Council file returns as taxable entities, and the change in filing status will make no material difference to our business. As a result, the Committees decided to eliminate this distraction.”

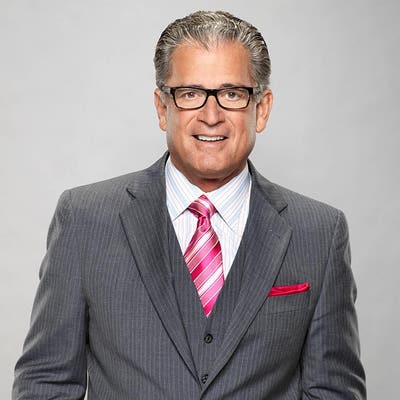

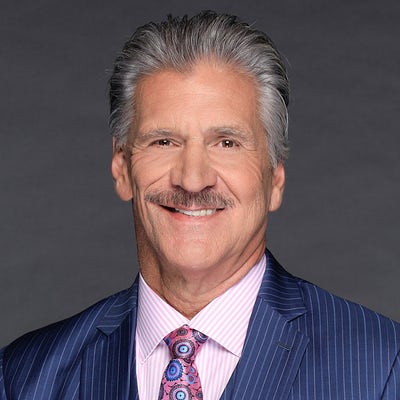

A statement released by Houston Texans owner Bob McNair, who is also chairman of the NFL’s finance committee, echoed Goodell’s memo and also characterized the old setup as a “distraction:”

“The income generated by football has always been earned by the 32 clubs and taxable there. This is the case whether the league office is tax exempt or taxable. The owners have decided to eliminate the distraction associated with misunderstanding of the league office’s status, so the league office will in the future file returns as a taxable entity.”

The NFL does not stand to lose a great deal of money by losing its tax-exempt status, which Bloomberg's Richard Rubin estimates will be $109 million over the next 10 years. In contrast, the NFL earned $10 billion in profits in just 2013 alone.

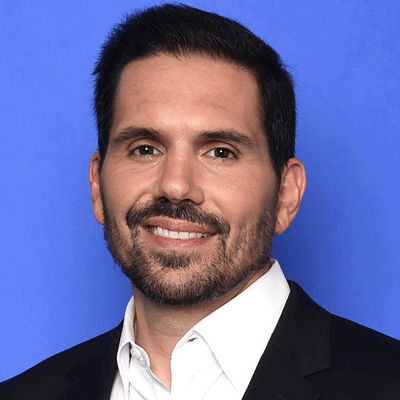

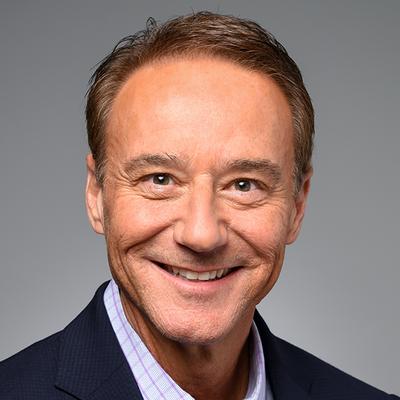

There had been multiple pushes by Congress to strip the NFL’s league office of its tax exempt status, including a recent attempt by Representative Jason Chaffetz, R-Utah. Though none of these attempts have passed the House or the Senate, the din has gotten louder as the league’s revenue has risen. Chaffetz and his colleague, Rep. Elijah Cummings, R-Maryland, released a statement praising Goodell’s decision (also via USA Today):

“We are extremely pleased with the decision from the NFL to waive its tax-exempt status. Congress has tried to tackle this issue before, but we made it one of our committee’s priorities this year. It is rewarding to see such an important and positive step toward restoring basic fairness. We hope other professional sports organizations in similar situations will follow the positive example set by the NFL, and we look forward to rightfully returning millions of dollars to the federal treasury as a result. We thank Commissioner Goodell and the NFL for their leadership.”

This move also brings some relief to Goodell and the league. As a tax-exempt non-profit, the NFL was required to publicly disclose financial data, including Goodell’s yearly salary and parts of their tax filings. Now, that information can remain private. Goodell, it should be noted, made $35 million in salary and various bonuses in 2013.

The NHL is now the last remaining professional sports league in the United States that has federal tax-exempt status; the MLB rescinded their non-profit status in 2007, while the NBA had never been a tax-exempt league.

More from Sportsnaut:

2024 NFL Draft best bets and odds

2024 NFL Draft Schedule: Date, time, how to watch, TV channel

2024 New NFL uniforms: Texans unveil redesign, new secondary logo

Could Dak Prescott and Bill Belichick team up in 2025 — on the Giants?

The Sum God: How Amon-Ra St. Brown’s record WR deal affects other star wideouts

Bears announce plans for new 'state-of-the-art' stadium near lakefront

5 Bold Predictions for 2024 NFL Draft: Texas DT Byron Murphy a top-10 pick

2024 NFL Draft odds: Chargers' odds to pick J.J. McCarthy rise on draft eve

Steelers reportedly not expected to pick up Justin Fields' fifth-year option

2024 NFL Draft best bets and odds

2024 NFL Draft Schedule: Date, time, how to watch, TV channel

2024 New NFL uniforms: Texans unveil redesign, new secondary logo

Could Dak Prescott and Bill Belichick team up in 2025 — on the Giants?

The Sum God: How Amon-Ra St. Brown’s record WR deal affects other star wideouts

Bears announce plans for new 'state-of-the-art' stadium near lakefront

5 Bold Predictions for 2024 NFL Draft: Texas DT Byron Murphy a top-10 pick

2024 NFL Draft odds: Chargers' odds to pick J.J. McCarthy rise on draft eve

Steelers reportedly not expected to pick up Justin Fields' fifth-year option